Details

General Availability in Select Markets (United States)

General Availability in Select Markets (United States) Procore Pay is available in the United States. It is designed for General Contractors and Owner-Builders who act as their own General Contractors on a job. Procore Pay extends the Invoice Management functionality in the Procore web application to handle the payment process between general and specialty contractors.

Procore Pay is available in the United States. It is designed for General Contractors and Owner-Builders who act as their own General Contractors on a job. Procore Pay extends the Invoice Management functionality in the Procore web application to handle the payment process between general and specialty contractors.

Procore Pay is available in the United States. It is designed for General Contractors and Owner-Builders who act as their own General Contractors on a job. Procore Pay extends the Invoice Management functionality in the Procore web application to handle the payment process between general and specialty contractors.

Procore Pay is available in the United States. It is designed for General Contractors and Owner-Builders who act as their own General Contractors on a job. Procore Pay extends the Invoice Management functionality in the Procore web application to handle the payment process between general and specialty contractors.

To enable Procore Pay with Procore Payment Services, Inc. , it needs to be activated by Procore. To do this, you'll meet with an Implementation Project Manager and a representative from Procore's dedicated Payment Operations team to provide your essential business details. Once activated, your team can begin adding their funding accounts and beneficiaries' accounts, establishing secure connections for financial transactions.

For a step-by-step guide for the Procore Pay implementation process, see Enable Procore Pay as a Payor.

Key Features

To begin adding business entities and streamlining your invoice payments when using Procore Pay with Procore Payment Services, Inc., your company's Payments Admin will use these key pages: Business Information, Beneficial Owners, and Business Controllers.

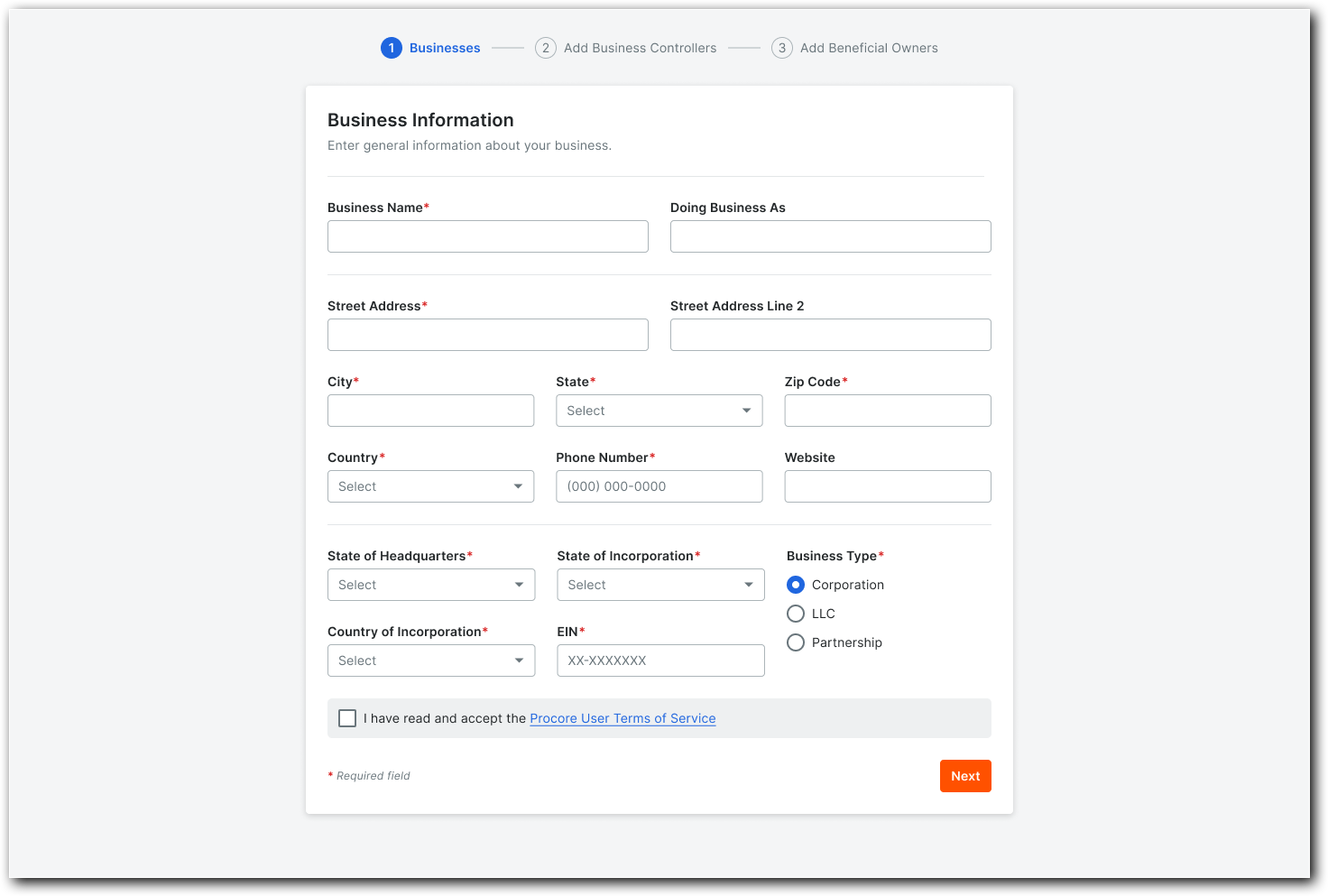

Business Information

The Business Information section requires you to input the legal details of your company, ensuring accuracy for verification purposes. This includes the official legal name, 'Doing Business As' name (if applicable), primary street address, and other essential contact information. You'll also specify the business's legal structure (Corporation, LLC, or Partnership), state and country of incorporation, and Employer Identification Number (EIN). Precise matches to legal documents are crucial to proceed smoothly through the verification process, which upholds regulatory compliance and ensures the secure operation of Procore Payment Services, Inc.

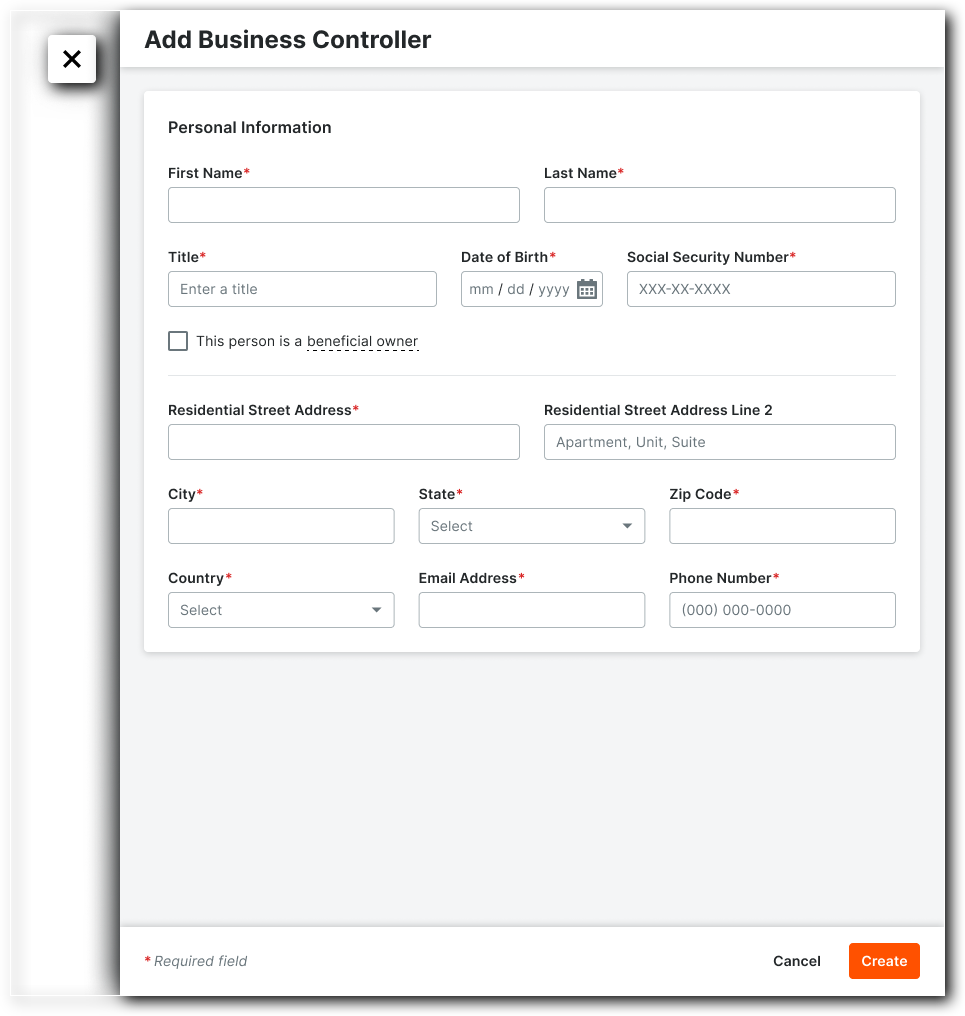

Business Controllers

Business Controllers are individuals with significant responsibility for managing the business. You'll need to input their legal names, titles, dates of birth, Social Security Numbers, and contact information. If a controller also owns at least 10% of the business, they should be identified as a business controller. Residential addresses and contact details are necessary for verification. Accurate and consistent information, matching legal documents, is also critical for compliance with Know Your Customer (KYC) regulations and to ensure the secure functioning of Procore Payment Services, Inc.

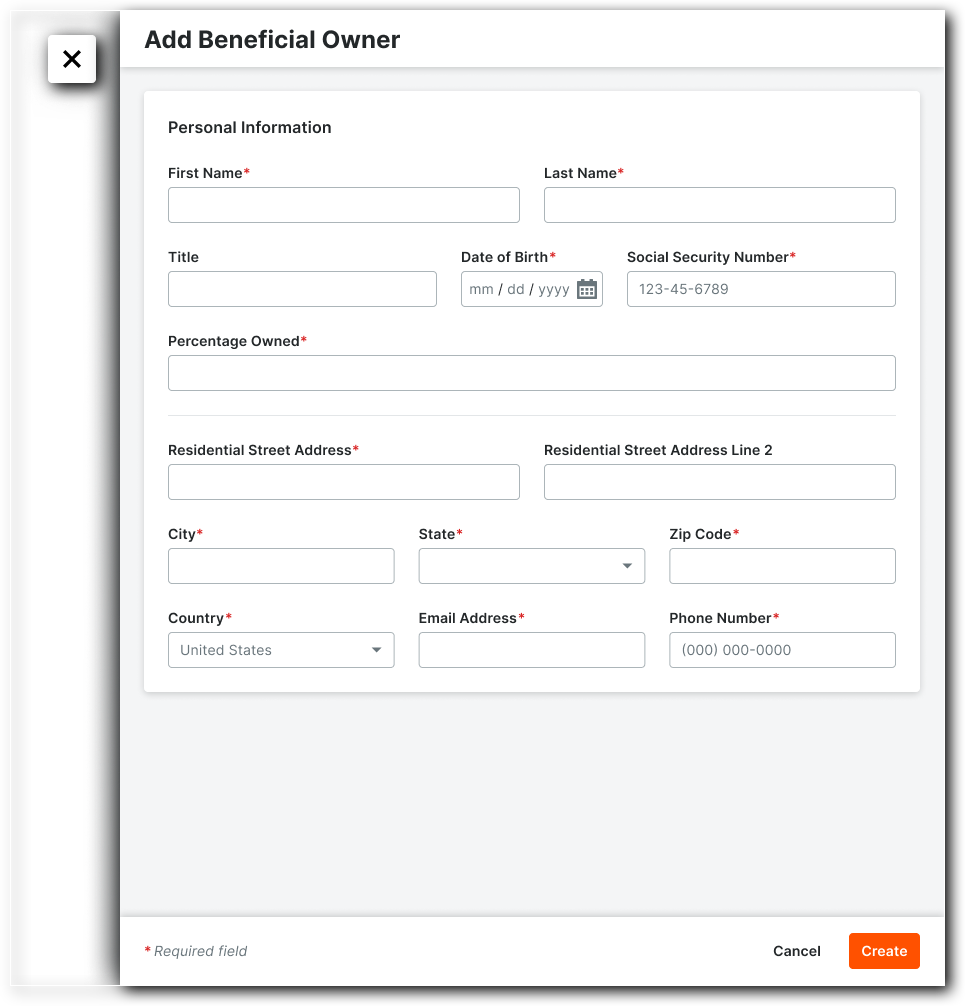

Beneficial Owners

Beneficial Owners are individuals who directly or indirectly own a significant portion of the business or exercise substantial control over the business. In this section, you'll provide their legal first and last names, titles, dates of birth, Social Security Numbers, and the exact percentage of ownership. Residential addresses and contact details are also required. The information provided must align precisely with legal documentation to facilitate accurate verification. This step is essential for complying with Know Your Customer (KYC) regulations and maintaining the integrity of the Procore Payment Services, Inc. platform.