Create Disbursements

General Availability in Select Markets (United States)

General Availability in Select Markets (United States) Procore Pay is available in the United States. It is designed for General Contractors and Owner-Builders who act as their own General Contractors on a job. Procore Pay extends the Invoice Management functionality in the Procore web application to handle the payment process between general and specialty contractors.

Procore Pay is available in the United States. It is designed for General Contractors and Owner-Builders who act as their own General Contractors on a job. Procore Pay extends the Invoice Management functionality in the Procore web application to handle the payment process between general and specialty contractors.

Procore Pay is available in the United States. It is designed for General Contractors and Owner-Builders who act as their own General Contractors on a job. Procore Pay extends the Invoice Management functionality in the Procore web application to handle the payment process between general and specialty contractors.

Procore Pay is available in the United States. It is designed for General Contractors and Owner-Builders who act as their own General Contractors on a job. Procore Pay extends the Invoice Management functionality in the Procore web application to handle the payment process between general and specialty contractors.

Objective

To create a new disbursement in the Company level Payments tool to pay subcontractor invoices as a Payments Admin or Disburser.

Background

With Procore Pay, only a Payments Admin or Disburser can create disbursements using the 'Subcontractor Invoice' tab in the Company-level Payments tool. A disbursement can handle up to 100 subcontractor invoice payments and saved as a 'Draft' for flexibility. Users can add or remove invoices in 'Draft' status before authorization.

With the Company level Workflows tool, payors can track invoice payment requirements and start a custom payments workflow for review and approval. Without the Workflows tool, Payments Admins or Disbursers verify and authorize payments directly. A Procore Pay disbursement initiates the drawdown request from the funding account and transfers funds to the deposit account to process and execute payment orders.

This table details the difference between a funding account and a deposit account:

Account Type | Definition | Purpose | Learn More |

|---|---|---|---|

Funding Account | A bank account used as the source to withdraw funds for disbursements. | Holds the payor's funds and releases them to the Deposit Account. | What are the different types of bank accounts in Procore Pay? |

Deposit Account * | Procore Pay initiates a reverse wire from the deposit account to transfer the funds for a disbursement from the funding account to the deposit account. | Receives the withdrawn funds to process and execute the payment orders for a disbursement's subcontractor invoices. |

* Procore is a financial technology company, not a bank. Banking services provided by Goldman Sachs Bank USA, a member of the Federal Reserve System and member FDIC. Additional Goldman Sachs Bank USA services may be accessed on its Transaction Banking online platform by visiting https://txb.gs.com/cx/login. Goldman Sachs accounts and services are subject to its terms and conditions.

Tip

TipNeed multiple deposit accounts? Need multiple deposit accounts? To avoid commingling funds and streamline reconciliation, you can open additional deposit accounts during or after Procore Pay implementation. Submit your request to Procore's Payment Operations team.

Need multiple deposit accounts? Need multiple deposit accounts? To avoid commingling funds and streamline reconciliation, you can open additional deposit accounts during or after Procore Pay implementation. Submit your request to Procore's Payment Operations team.

To receive payments, payees must have a free or paid Procore account and a user with administrator permissions must securely add a verified bank account. For more information, see Get Started: Payee Guides.

Things to Consider

Additional Information:

A single disbursement can handle up to 100 subcontractor invoice payments.

Invoice payments must be a positive amount. Procore Pay does not support negative invoice payments.

Disbursement contributors can only save their disbursements as drafts.

Payment Admins and Disbursers cannot authorize a disbursement if they are the last approver on any invoice within the disbursement.

Prerequisites

Payors must complete all steps in Enable Procore Pay as a Payor.

Payees must complete all steps in Set Up Procore Pay as a Payee.

Create at least one (1) commitment on a Pay-enabled Procore project. See Create a Commitment.

Create at least one (1) subcontractor invoice for a commitment and place the invoice into the 'Approved' status. See Create a Subcontractor Invoice.

Video

Steps

Review Invoices

Select Business Entity & Funding Account

Review Invoices

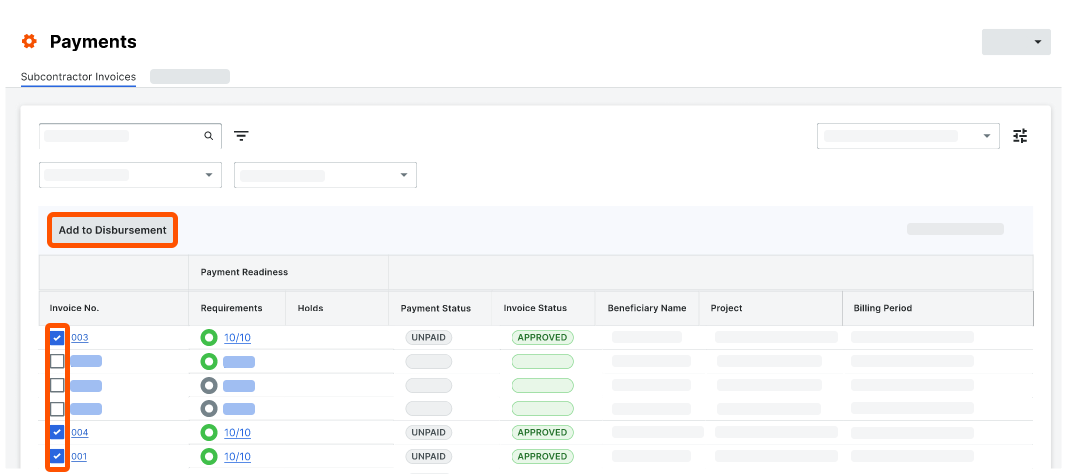

Navigate to the Company level Payments tool.

Click the Subcontractor Invoices tab.

Tip

TipAre invoices ready to pay? Use these tips:

Under Payment Requirements, a unit fraction in the Requirements column shows if an invoice meets payment requirements and an icon appears in the Manual Holds column if a hold has been applied. Only authorized users can manage and view payment requirements and holds. See Manage Payment Requirements as a Payor and Manage Payment Holds as a Payor.

Use the Search, Filter, and Group By options to narrow the list. See Manage Rows & Columns on the Subcontractor Invoices Tab and Search for and Apply Filters on the Subcontractor Invoices Tab.

Select one (1) or more 'Unpaid' invoice(s) by marking the checkbox(es) and click Add to Disbursement.

Note

If there are existing disbursements in the 'Draft' status:

To create a new disbursement, click Create New.

To add the selected disbursements to an existing 'Draft', select it from the menu. See Add Subcontractor Invoices to a 'Draft' Disbursement.

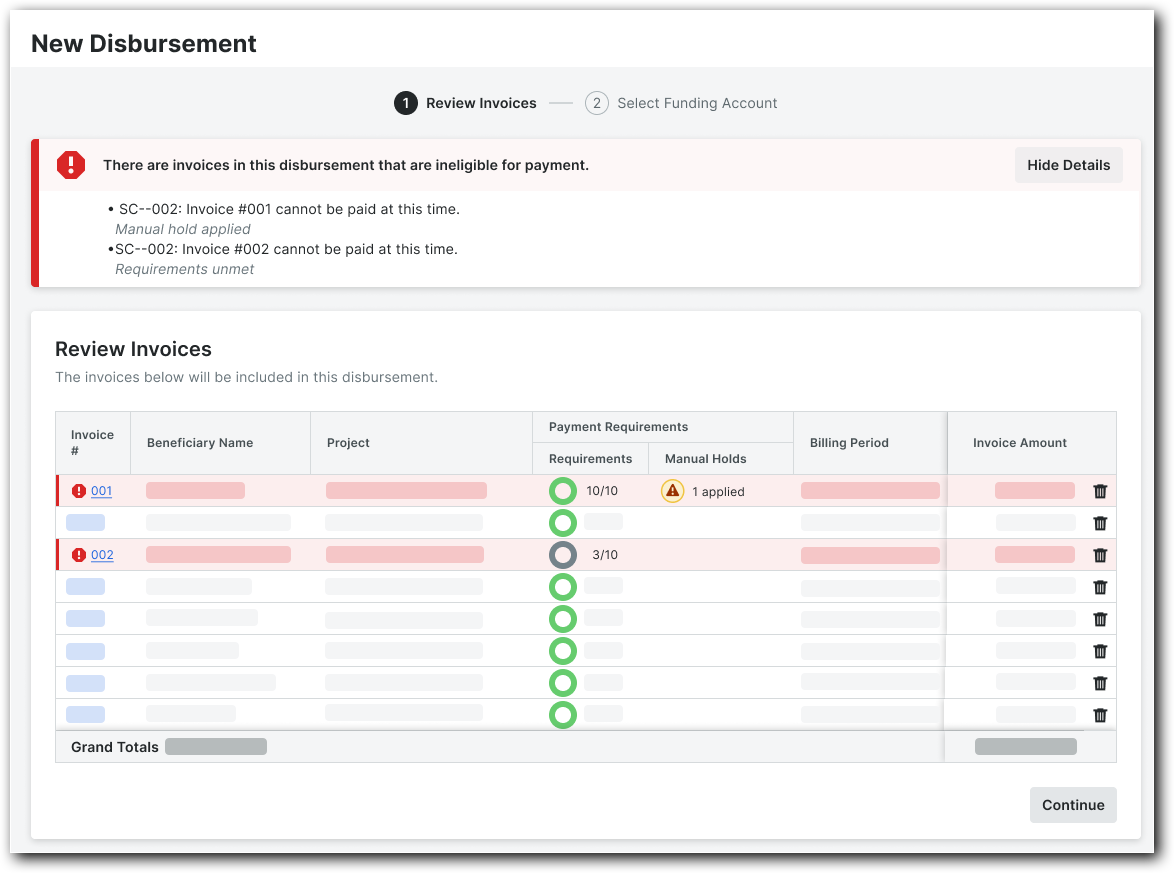

This opens the New Disbursement panel on the right side of the page.Notes

When using a custom payments workflow, the New Disbursement page contains two sub-pages: #1 Review Invoices and #2 Select Funding Account.

When not using a custom workflow, the New Disbursement page also contains a #3 Authorize sub-page.

In the #1 Review Invoices page, do the following:

Click Continue to proceed with the next step.

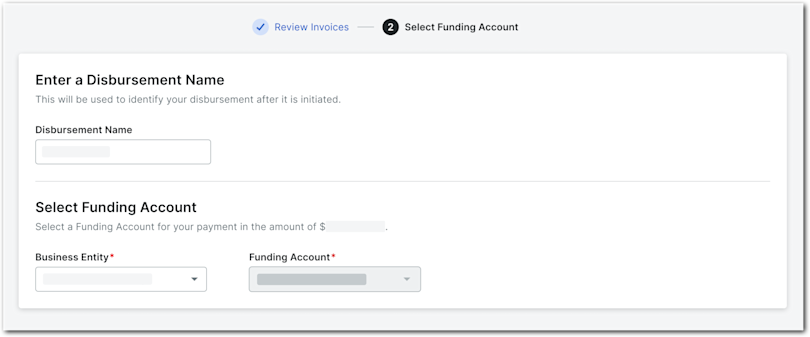

Select Business Entity & Funding Account

Your next step depends on whether your company configured a custom payments workflow. See Best Practices for Creating a Payments Workflow. For companies operating with multiple business entities, a Business Entity drop-down list appears.